Managing Business Receipts: Simplifying the Process

Oct 19, 2023

Receipts often create a headache for entrepreneurs, especially if you, like me, find managing paper overwhelming. However, with a well-organized system and the use of dedicated business accounts, you can streamline the receipt-keeping process, and chances are you may never need to refer to them again.

Why Keep Receipts? Receipts serve as essential proof of legitimate business expenses in case of an audit. For instance, if you spend $400 at Target, it's crucial to demonstrate that the purchase was for office supplies, not personal items like home decor.

When is it Necessary? Keep receipts when you pay in cash or for transactions exceeding $75. For purchases under this amount, your bank statement suffices for IRS documentation.

Tips for Hassle-Free Bookkeeping Without Constantly Referencing Receipts:

- Dedicated Business Card: Use your business card exclusively for business-related expenses.

- Split Transactions: When buying both personal and business items, conduct separate transactions and use different cards to maintain clarity.

- Reimbursement Trail: In case of mistakes, reimburse your business or yourself, ensuring a clear cash trail.

Organizing Receipts for Easy Access: I keep things simple by using Google Drive. Create a folder for business receipts each year and adopt a consistent naming convention like DATE-VENDOR-AMOUNT. This way, auditing becomes a breeze - receipts are sorted chronologically, by vendor, and amount.

Example: 2023-10-27 Target $190.89.pdf

For paper receipts, I use the Google Drive app on my phone to scan and save them as PDFs before discarding the physical copy. Electronic receipts are directly saved to the same folder.

Why Google Drive Works Better: Unlike email folders, Google Drive ensures a clean and easily accessible organization. Losing access to your email won’t mean losing your receipts - a much safer option!

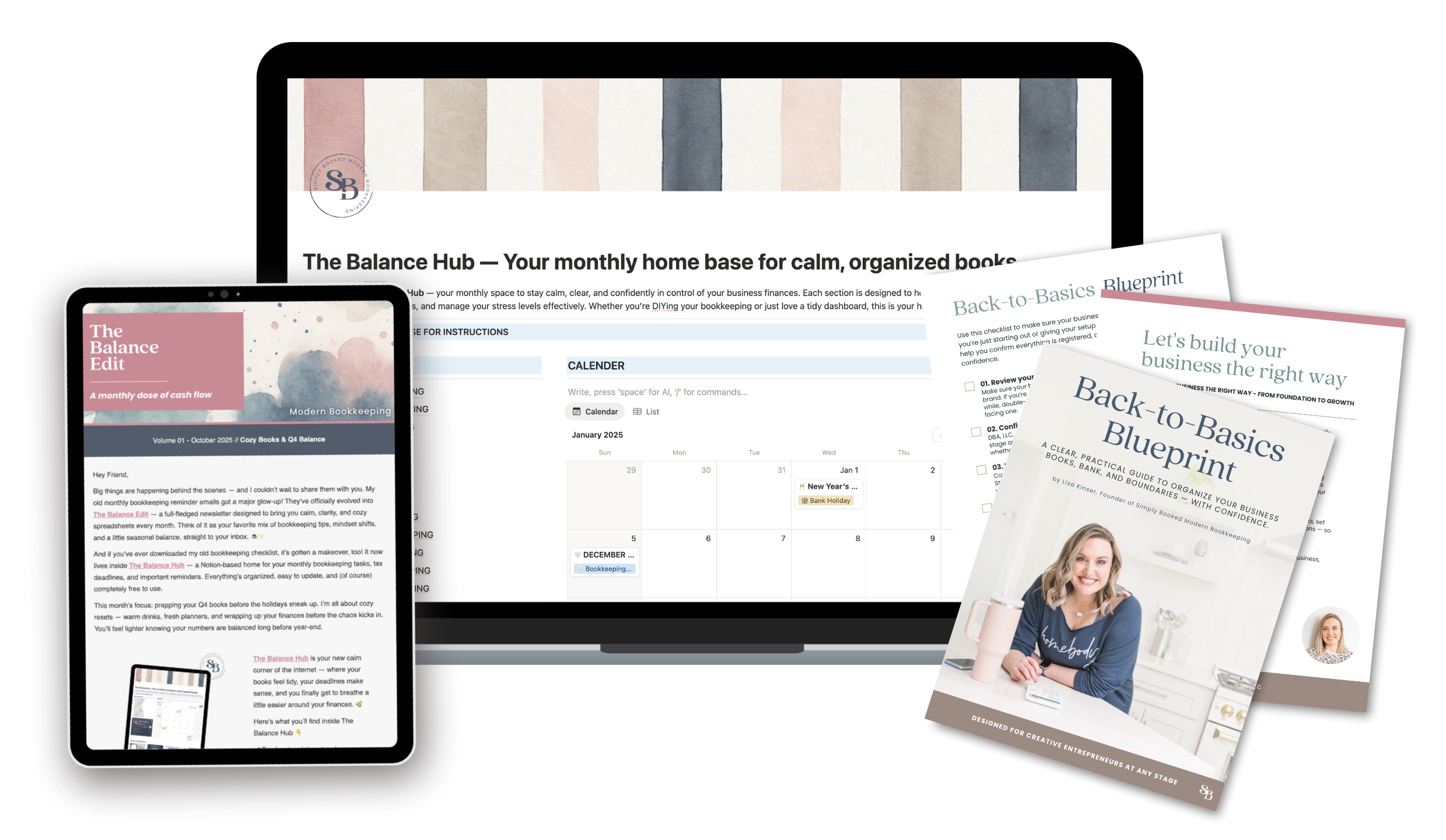

What's Next? Don’t forget to sign up for our free monthly bookkeeping and tax reminders. Stay on top of your finances effortlessly and avoid missing crucial deadlines.