015. My Business Didn't Fall Apart When My Life Did

Dec 09, 2025

(How building a grounded, numbers-backed business saved me through 18 months of loss, exhaustion, and zero growth mode)

Before We Begin — A Real Life Trigger Warning That Isn’t Here to Scare You

Let’s set the tone the same way I did before recording this episode:

This isn’t a grief-soaked, tissues-on-deck story. This is a healed-scar story. A hindsight story. A clarity story. And honestly, a story about power. My power. And the power I want every creative entrepreneur to have behind the scenes of their business.

I talk about loss in this post, because my life held a lot of it over the last few years. But the point isn’t the loss. The point is what that season revealed to me about the business I had built. And why I want you to build the same stability for yourself.

So if you’re here for something honest, human, slightly elder-emo-in-a-cardigan energy, you’re in the right place.

Let’s dive in.

The Three-Year Podcast Pause You Probably Noticed

When I hit record on this episode, it had been three years since I last sat behind my mic. Which is wild, because I didn’t intend to disappear. Life just… handed me a season and said “sit down.” And I listened.

If you’re new here: welcome.

If you’ve been here since 2021: you deserve a gold star, a high-five, and a front-row seat at my comeback party.

The truth is: I didn’t come back sooner because I wasn’t ready. Not emotionally, not mentally, and definitely not energetically. But now? Now I can tell this story without the shakiness that comes from an open wound. Now I can tell it with the grounded clarity that only hindsight gives you.

And more importantly, I can tell you what this season taught me about running a business that actually supports your life.

The Back-to-Back Losses That Became My Unwanted Reality

Here’s the real and raw timeline, because you deserve the full picture — not some sugar-coated spreadsheet summary.

Between early 2023 and August of 2024, my family experienced loss after loss.

- My father-in-law passed from prostate cancer.

- Nine months later, my mother-in-law passed suddenly after temporarily living with us.

- Both of our elderly rescue dogs died within that same window.

- And nine months after losing my mother-in-law, my stepdad passed due to Parkinson’s and dementia.

It was grief layered on grief layered on… honestly? Exhaustion.

Eighteen months of goodbyes.

There’s no entrepreneurial blueprint for that. No “three steps to keep growing during emotional collapse.” No corporate-approved resilience training that prepares you for your entire foundation shifting under your feet.

But in the storm, I made one decision that changed everything.

The Decision That Saved Me — and My Business

When you’re drowning, you don’t reach for your quarterly goals.

You reach for whatever floats.

Here’s what floated for me:

I kept serving my current clients.

Everything else? I shut down.

I stopped trying to grow.

I stopped pushing myself to be visible.

I stopped forcing a plan.

I logged out of Instagram like it was a toxic situationship.

And I gave myself permission to do only the essentials.

Just my client work.

Nothing more.

No pressure to perform.

No pressure to pivot.

No pressure to “be inspiring.”

It was the least CEO thing and the most human thing I’ve ever done.

And then something I did not expect happened.

The Plot Twist — My Business Didn’t Collapse

My business didn’t fall apart.

It didn’t shrink.

It didn’t panic.

It didn’t shame me for not hustling.

It didn’t whisper, “girl, you’re slipping.”

It held me.

My revenue stayed steady. Clients found me anyway. The seeds I planted before that season sprouted even though I wasn’t watering anything.

Some clients naturally cycled out, as life and business do, but nothing catastrophic happened. Not financially. Not structurally. Not emotionally.

And here’s the part I need you to hear with your whole heart:

My ability to step back did not come from luck.

It came from clarity.

Because I knew my numbers.

I knew my margins.

I knew what I could pay myself.

I knew how long my current workload could sustain my salary.

I knew the difference between “I want a break” and “I can afford a break.”

My paycheck showed up every single month — like clockwork.

Not because I worked like corporate wanted me to.

But because I built my business to support my actual life.

Corporate Never Told You This — But I Will

Here’s the spicy anti-corporate truth:

When you run your own business, you don’t need permission to have a bad day.

You can take a nap.

You can cry at noon.

You can reschedule everything and no one sends you to HR for looking “less engaged.”

Running your own business is freedom — but only if you build the systems and financial clarity that make that freedom real.

Otherwise, you’re just recreating corporate with worse snacks.

Let’s Talk About the Real Hero of This Story — Bookkeeping (Yeah, I Said It)

This is the part where I risk sounding like your friendly neighborhood bookkeeper, because well… I am. But this isn’t about spreadsheets. This is about safety.

My business supported me because I built it intentionally. And the foundation of that intention was clean, accurate books.

Bookkeeping helped me:

- Understand exactly what my business could handle

- Know how long I could slow down

- Keep paying myself even when I wasn’t “producing”

- Avoid panic spirals

- Make emotionally heavy decisions with financial clarity

This is why bookkeeping matters.

Not for tax season.

Not for gold-star “good business owner” status.

But because it builds a business that can actually hold you when life hits sideways.

Bookkeeping is emotional support disguised as numbers.

What This Means for You (Yes, You With the Overwhelmed Brain Tabs Open)

You deserve a business that doesn’t fall apart the moment you need to take a breath.

One that pays you consistently.

One that has deep roots.

One that gives you clarity instead of fear.

One that lets you step back without everything burning down.

You deserve to feel safe in your money decisions.

And you deserve to know your numbers well enough that you can disappear from Instagram for a month or a year without spiraling.

This isn’t radical.

This is sustainable entrepreneurship.

This is running a business that supports your life — not one that drains it.

And if you’re reading this thinking, “wow, I don’t have that yet,”

that doesn’t mean you failed.

It means you’re early.

Build Something That Holds You

This story isn’t about loss.

It’s about foundation.

It’s about resilience.

It’s about the quiet strength of knowing your numbers and trusting your systems.

I want you to have a business that protects your life, not one that makes you earn your rest.

My Comeback — And What’s Next

Thank you for letting me tell the truth about this season of my life.

Thank you for still being here.

Thank you for letting me return wiser, stronger, and honestly, far more aligned.

I’m excited for this new era.

I’m excited to teach again.

I’m excited to help you build businesses that don’t crumble in the storm.

Because if my business could support me in the hardest season of my life, yours can too — with intention, clarity, and systems built for real life.

If this post hit you in the chest the way it hit me living it, here’s your next move:

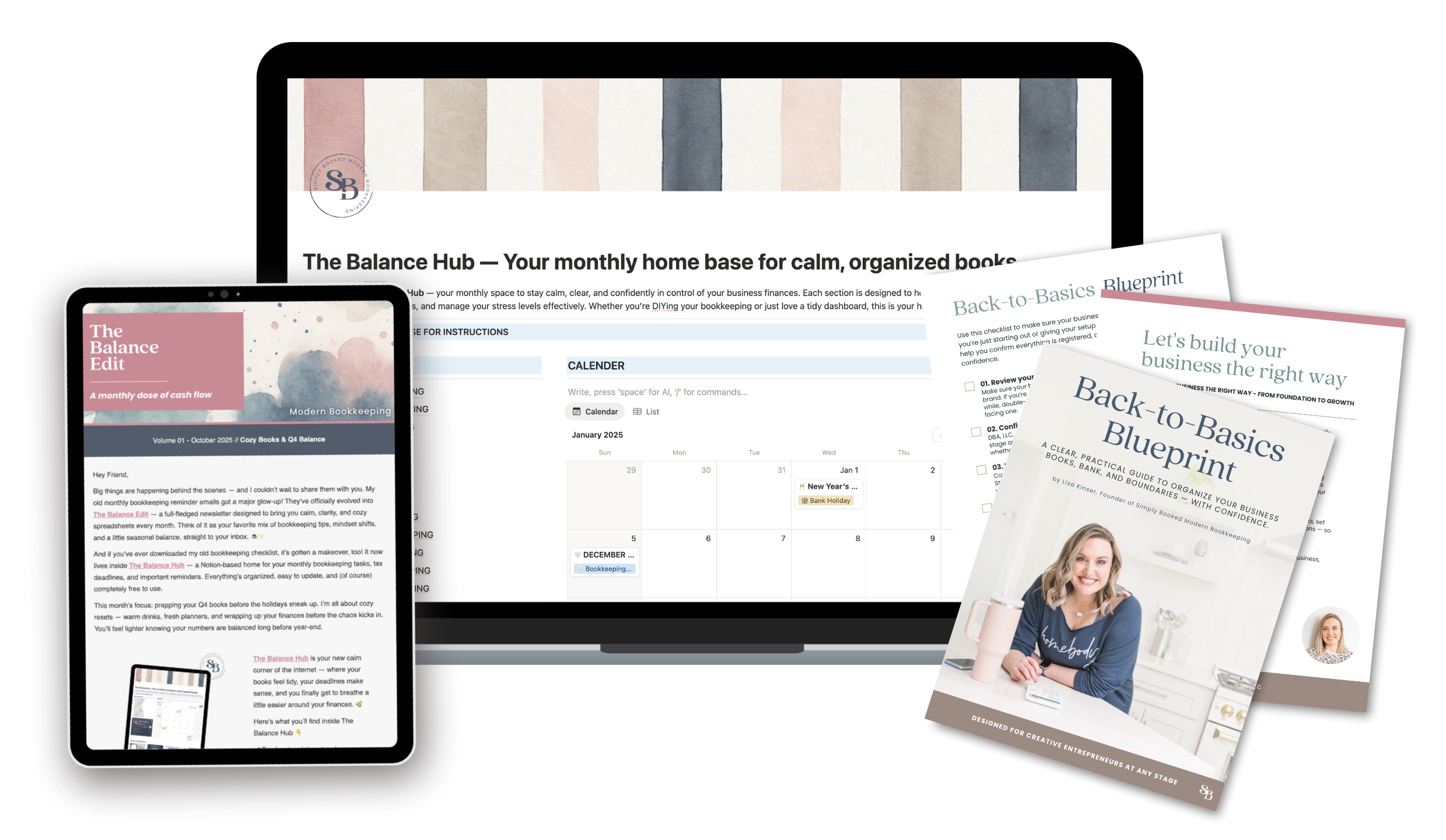

- Book a free discovery call: Get a Quote

- Browse the Simply Booked podcast library: The Simply Booked Podcast

- Grab the financial clarity resource: Balance Bundle

- Leave a rating or review because it helps more creative entrepreneurs find the support they need

You’re not meant to white-knuckle your finances. You’re meant to feel held by them.

And I’m here to help you build exactly that.